The Ultimate Financial Health Checklist for Small Businesses

If you are a business owner, creating a financial health checklist for your organization is one of the most important tasks. It allows you to make smart financial decisions and manage resources to ensure smooth cash flow. Regularly checking your business’s financial health is a good practice to ensure your books are in order and that everything is on track.

If you have not started doing this yet, now is the perfect time. This will also ensure that things do not get too hectic during tax season. A CPA in Richardson, TX, can be a valuable resource for the success of a business. They can provide you with a complete picture of your financial health and give further advice!

Financial health checklist for every small business owner –

-

Work out your financial ratios.

Firstly, you need to determine if your business is in good financial health. Financial ratios can help you do this. These accounting ratios calculate the financial data to determine the commercial performance of your business.

There are several financial ratios that can help you determine various factors, including liquidity, profitability, and finance. Some of them are as follows:

- Net profit margin

- Gross profit margin

- Debt-to-equity ratio

- Return on assets

- Return on equity (ROE)

By working out your financial ratios, you can determine how well your company has performed in the recent months or years.

-

Financial planning.

Taxes are an important part of businesses. As a business owner, you need to have a clear plan, goal, and objectives to come up with the most appropriate tax planning strategies. Make a list of personal and business financial goals and refer to them when making new decisions.

Find ways to lower the amount of taxes you owe. This can be done by claiming deductions, which are expenses you can subtract from your income before taxes are calculated.

-

Debt and credit review.

Gather all your loan and credit line statements. Make a list of each debt, including loan or crest line, balance, interest rate, and minimum payment.

Make sure to check your business credit score and credit utilization. A good credit score shows lenders you are reliable with debt. Explore opportunities to refinance existing debts.

-

Investments.

Many small business owners often make the mistake of investing all of their time and money into their business. To avoid such issues, maintaining a cash cushion for your business and personal financial needs is very important. This ensures you will have something to assess in case you ever run out of cash.

If you have some extra money left after covering your expenses and everyday living, invest it somewhere. By saving regularly and investing any extra cash, you are building a safety net for yourself for any future crisis.

Invest in companies from different parts of the geographies and with different services than yours. This way, if the economy slows down in your area, your investments in other countries might still be doing well.

-

Improve your debt collection process.

Collecting timely payments from customers and avoiding any delay is crucial for good business health. Delayed payments are a common problem in the construction and building industries.

Take steps to improve debt management. An easy way to do it is to prioritize debt payments. You can also invest in debt management software to follow up on unpaid debts. However, if you have them on a large scale or stubborn clients, you might have a bigger problem at hand.

Taking early action is very crucial as soon as the list of faulty debtors starts to build up. In such cases, hiring a professional debt collection agency is highly recommended.

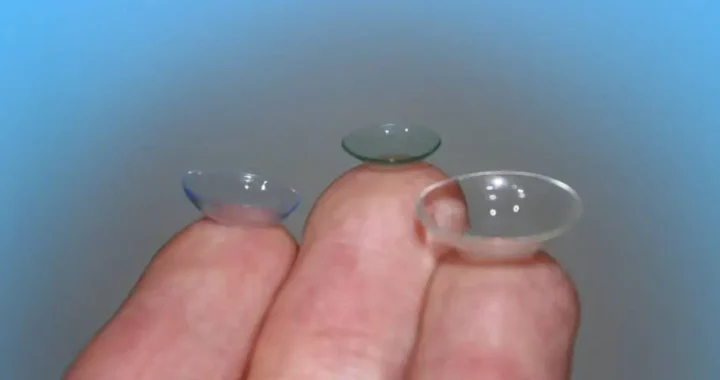

Soft vs. Rigid Gas Permeable Lenses: Which is Right for You?

Soft vs. Rigid Gas Permeable Lenses: Which is Right for You?  How to Know If You’re a Good Candidate for Laser Eye Surgery

How to Know If You’re a Good Candidate for Laser Eye Surgery  How Eye Lenses Help with Chronic Eye Conditions

How Eye Lenses Help with Chronic Eye Conditions  Can Exercise Improve Your Eye Health?

Can Exercise Improve Your Eye Health?  The Role of Supplements in Modern Health: A Balanced Perspective

The Role of Supplements in Modern Health: A Balanced Perspective  Which delta 9 gummies are known for their potency?

Which delta 9 gummies are known for their potency?  The Art of Healing: A Comprehensive Look at Modern Treatments and Approaches

The Art of Healing: A Comprehensive Look at Modern Treatments and Approaches  The Evolution of Medical Science: From Ancient Remedies to Modern Breakthroughs

The Evolution of Medical Science: From Ancient Remedies to Modern Breakthroughs